Overcapacity and involution: Who is "losing money and making noise"?

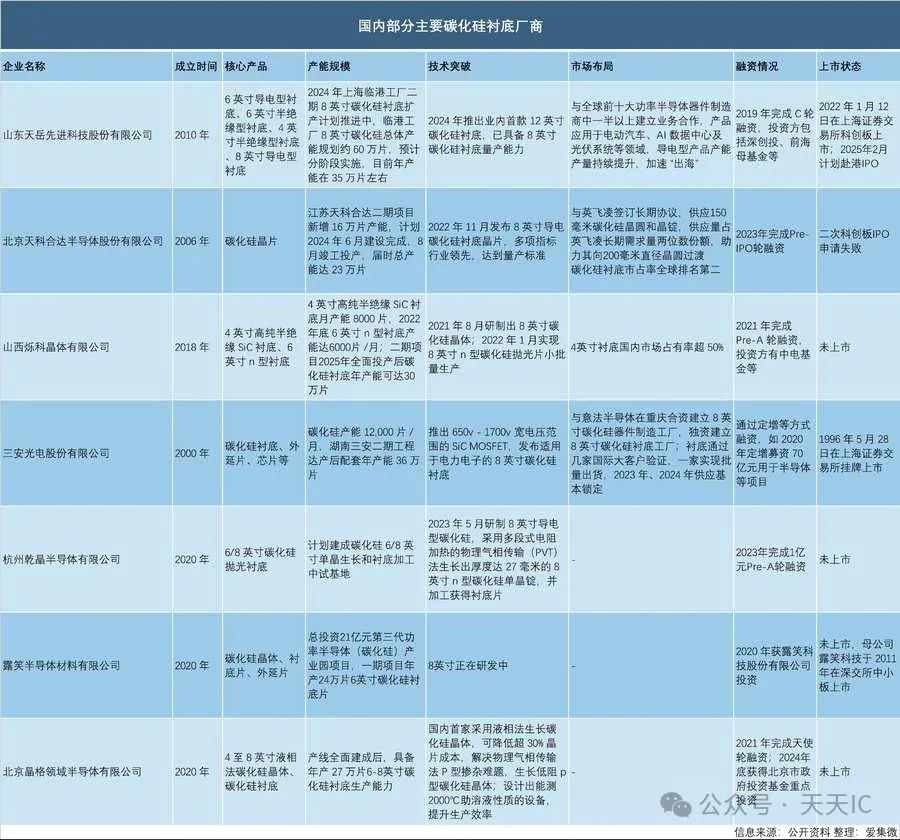

By 2024, the design production capacity of 6-inch silicon carbide substrates in China has exceeded 13 million pieces, but the global actual demand is only 1.5 million pieces, and the domestic actual sales are only 750000 pieces, with a backlog of up to 1.8 million pieces in inventory. The severe overcapacity situation has led to a sharp drop in prices, with the price of 6-inch substrates plummeting from a peak of 5000 yuan per piece to less than 2000 yuan, directly breaking through the cost line. Major manufacturers such as Tianyue Advanced and Tianke Heda have continued to decline in net profit despite increasing production capacity, with some quarters even experiencing losses.

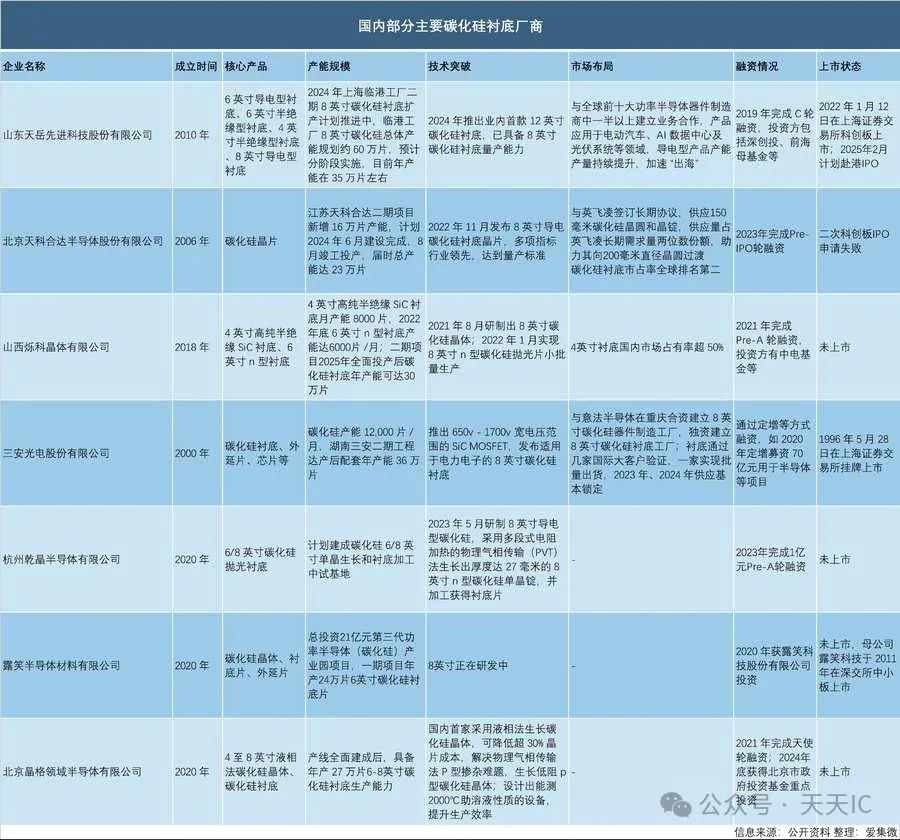

Major domestic silicon carbide substrate manufacturers

The root of all of this lies in the old model of "policy subsidy driven", where local governments provide support such as land and tax incentives in order to compete for industrial projects, while enterprises hastily build production capacity, ignoring the actual market demand and technological accumulation. The homogenization of products between enterprises is severe, and they can only compete for market share through price competition. This not only compresses the profit margin of the enterprise, but also reduces R&D investment, leading to technological innovation stagnation and further exacerbating the problem of product homogenization.

Technical Battle of Life and Death: PVT Veteran vs. Liquid Phase Method Newcomer

There are two main production technologies for silicon carbide substrates: traditional physical vapor transfer (PVT) and emerging liquid-phase methods. PVT technology, due to its low cost and mature process, allows silicon carbide gas to condense into crystals at high temperatures. However, this method has defects such as microtubule density and dislocations, resulting in a yield rate hovering below 50% for a long time and a clear bottleneck. In contrast, the liquid-phase method crystallizes at lower temperatures, resulting in lower defect rates and excellent crystal quality. However, it has a higher technical threshold and higher cost. At present, the liquid-phase method still faces challenges in terms of growth rate and cost, but its quality advantage has quickly made it a strong competitor in the new generation of silicon carbide crystal growth technology.

The average selling price trend of silicon carbide epitaxial wafers and substrates

Therefore, companies need to find a balance between PVT and liquid-phase methods through technological innovation. Some enterprises have adopted the innovative technology route of "PVT+liquid phase method" to produce high-quality seed crystals through liquid phase method, and then use PVT process for large-scale production, which not only reduces costs but also significantly improves yield. This technological approach helps alleviate internal competition and improve the cost-effectiveness of products.

8 inch substrate: the next battlefield or foam?

With the continuous advancement of technology, 8-inch substrates have become an important direction for future development. The price of an 8-inch substrate is three times higher than that of a 6-inch substrate, and the market demand is strong, especially in high-end markets such as new energy vehicles and data centers. Tesla, BYD and other car companies explicitly require the use of 8-inch substrates, making them a must-have in the high-end market.

However, the expansion of 8-inch substrates also faces significant risks. The actual demand for 8-inch substrates worldwide in 2024 is only 150000 pieces, but the planned production capacity in China has exceeded 4 million pieces. If there is excessive expansion, it may once again fall into the "tragic" situation of the 6-inch market. Although the demand and price for 8-inch substrates are relatively good, issues such as quality, yield, and capacity building still need to be resolved. Some enterprises, such as Tianyue Advanced and Jingsheng Electromechanical, have made progress in the production and technological research and development of 8-inch substrates, but still need to strengthen quality control and production efficiency.

New way out: from "price war" to "scenario war"

As the price war intensifies, companies have to explore new development paths. On the one hand, the price reduction of silicon carbide substrates has promoted their penetration rate in the market, especially in the fields of new energy vehicles, photovoltaics, energy storage, etc., where their applications have been greatly expanded. On the other hand, some companies have begun to shift from simply "selling substrates" to providing customized solutions for customers, such as customizing automotive grade chip substrates for car companies or establishing joint research and development centers with downstream giants, and turning to "scene revolution".

In addition, silicon carbide has enormous potential in emerging applications such as data centers, AR glasses, and photovoltaic energy storage. Especially with the rapid development of AI data centers, it is expected that silicon carbide modules will be widely used and bring huge electricity cost savings. AR glasses and photovoltaic energy storage will also become new growth points for silicon carbide demand.

Survival Law: Either Subvert Technology or Subvert Yourself

Faced with the dilemma of "internal competition" in the industry, enterprises need to achieve breakthroughs through technological innovation, expanding application areas, and industrial chain collaboration. Whether through technological breakthroughs in liquid-phase methods or the development of emerging application fields such as AR glasses, companies must make strategic choices at critical moments of industry reshuffle.

Technology disruptors

Through innovative technologies such as liquid-phase method and heterogeneous integration, breakthroughs have been achieved, and cooperative universities have overcome the problem of defect control and made progress in the field of 12 inch ultra large size substrates.

Scene Revolutionaries

Turn to providing customized solutions for customers and establish joint research and development centers with downstream enterprises such as CATL and Huawei.

Cost killer

Optimizing production processes through AI technology, improving PVT yield, and reducing costs through supply chain layout.

From international experience, companies like Wolfspeed that achieve full industry chain cost optimization through the "IDM model" provide reference for domestic enterprises. Domestic enterprises need to make up for their shortcomings in equipment and extension, and leverage China's leading position in the fields of new and green energy to promote industrial upgrading.

conclusion

Although the silicon carbide industry is currently facing fierce competition and price wars, there are still huge opportunities within the industry. With technological breakthroughs and the expansion of application scenarios, silicon carbide will become an important component of the future semiconductor industry. Through technological innovation, scenario expansion, and industry chain collaboration, enterprises are expected to achieve breakthroughs in the coming years and stand at the top of the global semiconductor industry pyramid.